The property Investment Boutique you Haven't Heard of

The Challenge of Attracting new Investors

Barwood Capital may not be a familiar name, but in one form or another it has been around for 20 years.

With its focus in the golden triangle of England, the company originally started its life as a commercial property developer.

Managing director Joanna Greenslade says that the unique selling point for the company is its experience and its focus on the regions rather than city centres.

‘So many of our investors struggle with sourcing the right deals and right opportunities,' she said.

'The second thing is our development roots. A lot of investors want to put money in an income-oriented stock but the development and planning skills we bring is quite unusual for investors.’

It was only around a decade ago that the business actually started offering clients funds they could invest in.

‘About 10 years ago we decided we needed to diversify the business so we expanded into residential development and into strategic residential land,’ she explained.

At the same time, the company was approached by high net worth individuals in the region asking for a solution to their return problems. That’s when the firm created an FCA authorised legal entity and began running collective investment schemes.

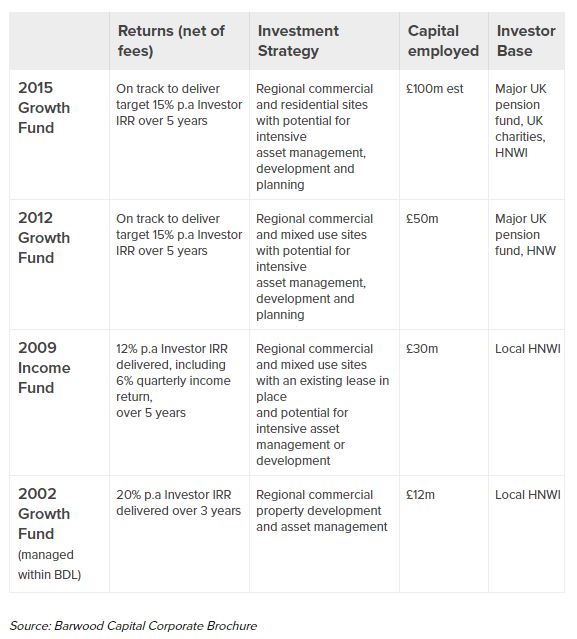

So far it has launched four property funds, raising over £200 million since 2009. Its latest fund in 2017 has raised £66 million to date, with the final close expected in the next three months. The minimum entry level for investors is £1 million.

Guy Brogden, who was recently appointed as executive chairman, describes the strategies as ‘private equity for property’.

‘Because we are focused on delivering development profit, we are much more creative than the average investment management group who are running an income fund,’ he said. ‘What we do is we buy property intelligently, which usually means cheaply and we add value to it by getting development consent or refurbishing.’

In the aftermath of the Brexit vote, when a lot of property funds struggled due to redemption requests, Brogden says Barwood’s experience was quite different.

‘All our funds at the moment are closed-ended. The big funds are driven by sentiment, we have a group of investors who are more sophisticated. They go on instinct, experience and that sort of thing. So when Brexit came along, they couldn’t get out even if they wanted to but we communicated with them and they were comforted by that.’

While finding the right opportunities and the property to add material value to is not an issue, attracting new investors is a challenge for Barwood.

Greenslade said that the funds have a very loyal investor base however she added: 'The challenge which is a new one for us over the last year or two has been to break into the investment market and identify the route to market to bring new investors in.'

This is compounded by the challenges of regulation where people instinctively shy away from collective investment schemes, she said. However, wealth managers and advisers are starting to introduce those clients who are interested in property to Barwood, which helps overcome the challenge of finding new investors.

Published in Citywire