Market Update From a Boris Bounce Into a Covid-19 Crisis

Barwood Capitals Resilient Funds Continue Investment Strategies

After a year dominated by both political and economic uncertainty due to Brexit and a Parliament with little or no power/authority to make decisions, 2020 was predicted to be a year for optimism following a landslide victory for Boris and his Conservative party. The first two months got off to a flying start with the resurrection of regional infrastructure projects promised Government investment into the UK regions, unemployment at an all-time low, a housing market surge and from a real estate perspective an anticipated 20% rise in overall investment transaction volumes.

Sadly this “Boris Bounce” was not to last, with the rapid and indiscriminate spread of Covid-19 leading to markets around the world experiencing huge disruption. The resultant human, economic and financial impacts are both significant and ongoing and the UK commercial real estate market is not immune from this virus.

What Happened?

The first confirmed case of Covid-19 was in China in November 2019, with the first recorded case in the UK confirmed in February 2020, leading to dramatic fiscal and monetary responses from governments and central banks across the world.

In the UK, the Government and Bank of England announced unprecedented measures:

-

Reduction in the central bank base rate by 65 bps, to 0.1%.

-

£330bn loan guarantee scheme for companies.

-

Suspension of business rates for highest risk sectors (taxes on tenants in a property).

-

Suspension of enforcement against tenants for default on rental payments.

-

£27bn support package for the payment of employees’ wages and incomes for the self-employed.

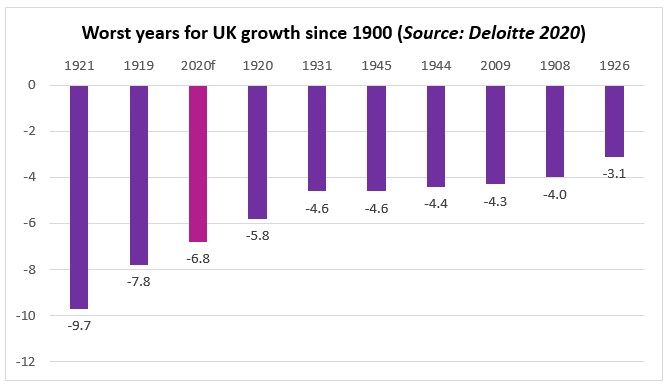

Capital Economics, a research consultancy, estimates that UK GDP will fall by approximately 15% in Q2 and unemployment will increase from 4% to 6% over the course of the calendar year. Forecast negative GDP growth and rising unemployment are principally a function of the Government mandated ‘social distancing’. As seen in the graph below, it is currently forecast that 2020 will be one of the worst years for UK growth since the economic depression of 1921, however, the extent of this will be entirely dependent on the Government’s response to the crisis and the speed at which the UK rebounds. Thankfully prior to the crisis, the UK was generally in a healthy economic state with historically low unemployment, positive GDP growth and the liquidity of banks. Investors have been concerned by uncertainty around the duration and depth of the outbreak, and the consequences for economic activity.

In the UK commercial real estate markets, the most tangible metric at present is the FTSE 350 REIT Index, which has fallen by some 20% since the beginning of February driven by concerns about payments of rent and the knock-on effect of investors’ ability to service bank interest and where relevant pay shareholder dividends. In 2019 the overall average figure for the collection of rents on the due date was 79%, whilst in April 2020 this figure is 48% (Source: Remit Consulting, 9/4/20).

Industrial

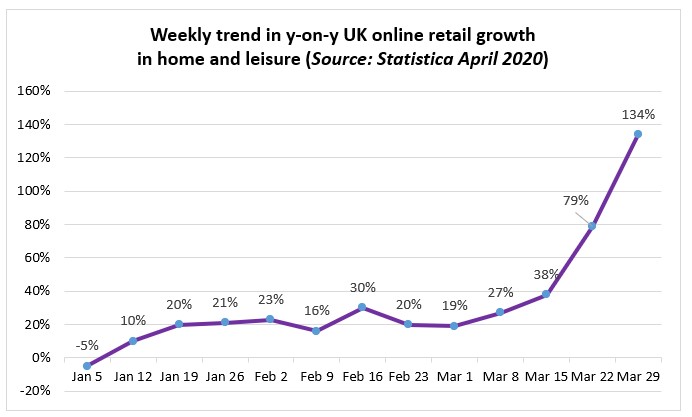

In conclusion, demand for warehouses remains strong.Online shopping is proving invaluable in this time of need, with more consumers – including those who may have initially been resistant to shopping online – opting for home delivery. The Covid-19 outbreak may be a catalyst for changing consumer behaviours that will both accelerate the pace of adoption and raise the ceiling of what can be transacted online.In addition, there is likely to be a renewed focus on supply chain resilience and warehouse automation.

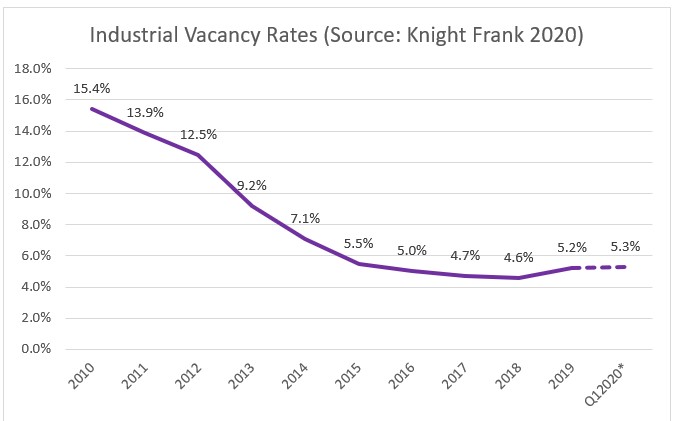

In the short term the impact of the Covid-19 crisis on the industrial/warehousing sector is more complex. With extensive shutdowns industrial output will see a sharp drop in H1 2020 however short term space requirements for warehousing have increased and the industry has come together to collaborate in this crisis. The NHS reportedly took an extra 14.25 million sq ft of industrial space in one week at the end of March and Clipper Logistics has been contracted by the NHS Supply Chain to provide services to establish a new supply chain for the delivery of personal protective equipment to NHS facilities. Irrespective of this, with industrial vacancy rates at just over 5.25%, there is still likely to be further upward pressure on occupancy rates and rents.

Office

The rapid mobilisation of remote working as a corporate response to the Covid-19 crisis has clearly been driven by a fundamental short-term need to keep the business wheels turning. Yet the relative success of such a move is likely to have longer-term implications for the way that businesses think about and structure their real estate portfolios. It will lead some to question whether they need as much office space and many more to agonise over whether they have the right space in the right places for the post Covid-19 world.

Overall we believe that office occupiers will consider further rationalisation of office space in the future, which will result in increased density but lower aggregate demand for space. In the short term, new office occupiers are likely to put space decision making on hold and existing users of relatively expensive coworking spaces will likely reduce their commitments. In Central London, it is estimated that coworking demand has shrunk 90% since the beginning of the epidemic.

Thankfully however, prior to the crisis the supply of grade A office space in the main UK regional cities was in most cases well below the market average, with the likes of Bristol having the lowest availability. This is unlikely to dramatically change due to the Covid-19 crisis and in the medium term will continue to offer selective opportunities to reposition secondary office space in the right location within city centre.

Alternatives

Investors in specialist sectors such as retirement living, datacenters, student accommodation, healthcare and hotels are seeking to understand the impact of the Covid-19 crisis on their underlying operational businesses and cashflow of those assets as quickly as possible. In turn, operators are looking at short- and long-term impacts on their ability to turn to real estate investors to raise capital.

Key demographic and structural trends remain which underpin the majority of these sectors - such as an ageing population, growth in data traffic, investors seeking yield in a “lower for longer” world and institutions wanting to access long leases to match long duration liabilities. However, some sub-sectors such as student accommodation and hotels have been severely impacted, at least in the short term, by Covid-19.

Never has the healthcare sector been in the spotlight to such an extent and rarely has the interaction between the public and private sectors been so constructive and collaborative. There is now huge potential for a new era of partnership between the NHS and its private sector counterparts. There are numerous examples of care home occupancy increasing as the NHS frees up capacity by rapidly ‘un-blocking’ beds, and the NHS and Local Authorities contracting directly with care home owners so that individual beds, or wings, or entire care homes can be used for Covid-19 recuperation. The care continuum is being used far more effectively across the market with the change having happened quickly, and there is no reason why this interaction between acute and social care should not continue in a post Covid-19 environment.

Operationally, whilst the risk of a catastrophic infection at any given home is unavoidable, these businesses are used to dealing with infection control generally. There is likely to be a spotlight on cases in care homes, and providers have reported ongoing concerns regarding protective equipment and staffing levels which are largely beyond their control. In contrast, some operators report a surge in applications for employment, which is a trend that is often repeated in times of economic downturn. Whilst the national shortage of nurses will not be eased in the short term, an absence of employment opportunities for non-qualified staff in retail, leisure and hospitality sectors is assisting care home providers to fill vacancies. Care homes are a needs’ driven industry and demographic drivers for the market will not change substantially in a post Covid-19 world.

We have taken soundings from some senior people in the care home sector and the overriding message is that this is not anticipated to have long term repercussions for the industry, particularly now a full lock down is in place which they are viewing constructively. Requirements for new homes are still being actively progressed by those who have strong balance sheets, which supports our focus on prime locations and top tier covenants.

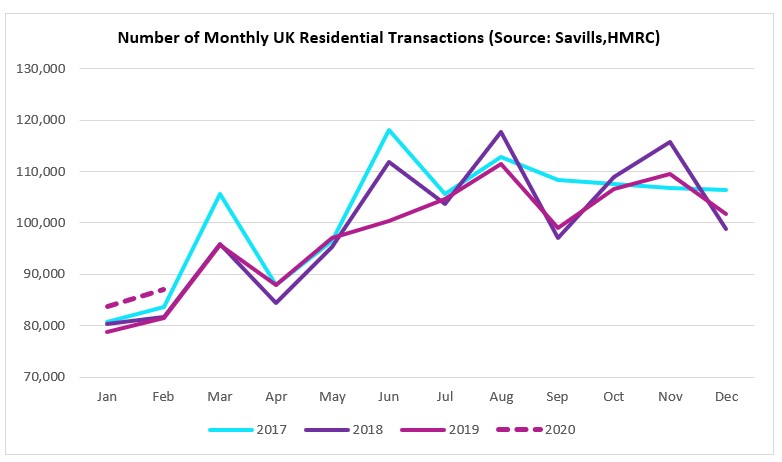

Residential

The new decade started with housing transaction levels up and mortgage approvals at a six-year high. Sales rallied as certainty returned to the market after the result of the General Election and clarity over the Brexit Withdrawal Agreement. The graph below shows the strength of sales activity at the start of 2020 relative to recent years.

That positive sentiment was quickly extinguished as the Covid-19 crisis effectively stopped the housing market in its tracks. The data is not yet available, but housing transactions will be significantly impacted over the next few months as Government restrictions limit people’s ability to leave their homes. Mortgage approvals are expected to fall sharply as mortgage providers seek to stem the flow of new business so they can service the increased requests for mortgage holidays. Analysts expect a 50% drop in housing transactions year on year for 2020.

However, most estate agents continue to market their existing properties on the online property portals with analysts expecting the suppression of activity to create a build-up of latent demand, which should drive sales in latter half of the year.

Due to the level of uncertainty in the market it is difficult to predict what the effect of the Coronavirus lockdown will be on capital values. Savills expects prices to fall by 5% - 10% in the short term and recover by Q1 2021, suggesting that low interest rates and lenders’ tolerance for arrears will reduce any forced sales which should mitigate the fall in house prices. Additionally, three years of price stagnation after the Brexit referendum means pricing was more realistic and should be more resilient and therefore with pent up demand likely to increase for new homes outside major conurbations during Covid-19. Savills is still forecasting house prices to grow by 15% over the next five years.

Development/Construction

Government advice is currently to continue on site if guidelines on mandated “social distancing” measures between workers and sanitation can be complied with. Barwood Capital sites tend to be small, located in less populated areas and with less reliance on public transport. We are liaising regularly with our development and site managers to ensure that if sites stay operational that they are fully complying with these guidelines, but if this is not achievable then they are being closed.We have built 3-month delays into our forecasts for all sites unless close to practical completion.

To date Local Authorities, have in many cases continued to manage planning applications remotely as legislated for by the Government. However, delays in planning are expected as a result of staff not being able to work to prescribed timetables. The suspension of Council planning committee meetings is also likely to cause problems, although the Government has sought to encourage more delegated decision making for planning officers or to hold committee meetings via video link.

Investment

The property market in the UK is expected to be significantly impacted by the Covid-19 crisis, with the latest views showing a material reduction in values and little or no rental growth.However, as per the last few years there is a wide range when you look behind this into specific sectors with industrial possibly even being a beneficiary of the crisis whilst retail, leisure and city centres taking the brunt of the fall. Capital Economics’ base case forecast is for a 10% decline in UK commercial real estate values this year, whilst its downside case assumes a 25% fall in value, in line with the global financial crisis. Some prime and well-let properties on long-term leases to strong covenants may well however, hold their value or at least suffer limited value declines. Transaction volumes are significantly down this quarter and very few new assets have come to the market. Most investors are taking a ‘wait-and-see’ approach to assess the full economic impact of the Covid-19 crisis on occupier markets before jumping back into the investment market.

From a banking perspective, most lenders are focused on dealing with issues surrounding LTV and ICR breaches on existing loans. Banks will need to waive interest and value covenants for Q2 and potentially Q3 2020 in order to avoid a wave of defaults. In the medium term, the Covid-19 crisis is likely to create opportunity in the form of distress as asset owners seek liquidity and pricing falls. This will likely emerge after the summer of 2020, as re-pricing occurs across the real estate market.

From a Barwood Capital point of view, we have done a thorough ‘ground up’ exercise on every single asset, for example considering if there are existing tenants who need rent holidays, delays on sites in construction, delays to sales etc. This exercise has given us considerable comfort that our Funds are extremely resilient to the extraordinary circumstances we are in and endorses our continued investment strategies.

In relation to our Growth Funds and based on revised prudent assumptions we are still anticipating delivering double digit returns and on a further stressed scenario every Fund is still expected to deliver a healthy positive return to investors with the Covid-19 crisis only resulting in a potential 100-200bps impact on our forecast investor IRRs for existing Funds and little impact on our new Growth Fund IV. In relation to our Residential Platform and based on revised prudent assumptions (building in at least 3-month delays) we are still anticipating delivering around our target 1.25x equity multiple, albeit over a slightly longer timeframe for existing packages.

What Lies Ahead?

Landlords will need to improve engagement with tenants, adopting a collaborative approach to problem-solving. It is likely that economic disruption caused by the Covid-19 crisis will speed up trends already set in motion i.e. the decline of non-food retailers, greater remote working, increased investment into online, online sales growth, the advancement of “PropTech” software and carbon neutral targets. The Government fiscal stimulus into the market may not rescue 2020 but will likely boost asset values in 2021. Fewer assets will be transacted in 2020 as buyers and sellers assess the impact of the Covid-19 crisis on the economic landscape. Landlords will continue to be focused on rent collection, tenant defaults and managing loans, although most banks will look to help, as the problem is so widespread.

As liquidity dries up potentially in Q2 and Q3 2020, there may be unique opportunities to acquire institutional quality assets at discounted prices – particularly for fast-moving cash buyers, although the window for such opportunities may be small. A reduction in planning consents will reduce supply of residential sites and alongside a decline in construction output, this will exacerbate housing supply shortages in years to come.

We believe that Barwood Capital’s investment strategies are strong and resilient, notwithstanding the current Covid-19 challenges, as the fundamentals underpinning them have not changed. We have a very healthy pipeline of sensibly priced opportunities that significantly exceed our current funds available. We continue with our planned Fund raises and have multiple investors in due diligence / reviewing our data room and fund information, who we expect to invest with us this year.

Hugh Elrington

Managing Director, Barwood Capital