Covid-19 Continues to Effect the UK Property Market

Forecasters Expect a Return to Growth in 2021

As Covid-19 continues to strengthen its grip, it feels frustratingly repetitive to open this quarterly update with reference to the same dilemma that we all continue to face. As the second wave gathered momentum through the Autumn months of 2020, we entered 2021 with a fresh round of lockdown restrictions not too dissimilar to those experienced in March last year, albeit a little looser. Optimism and the gulf between hope and reality has never been so challenging to define.

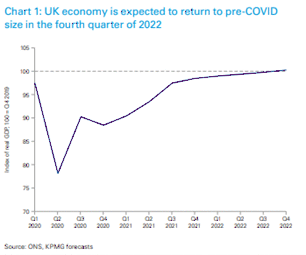

Despite all this and whilst the pandemic still roams strong, the consensus is that 2021 will be a good year for the global economy and if so, the UK should not be too far behind. The global economy shrank by c4.5% last year but forecasters expect a return to growth in 2021 at a similar level. Looking at some key factors:

-

A Brexit deal has been struck.

-

A new President has entered the White House.

-

The UK Household Savings Ratio rose to 26.5% in Q2. (ons.gov.uk)

-

There is scope for consumer spending to rebound strongly once restrictions are lifted.

-

Peak unemployment is anticipated to be lower than feared and finally, let us not forget…

-

We have a vaccine.

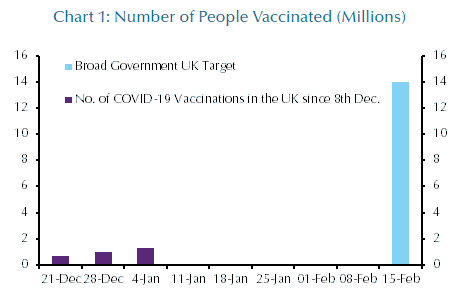

Take these reasons to be optimistic as you will, but having a vaccine should be the shining light at the end of the tunnel that we have all been hoping for. The UK Government shares a similar view and has linked the easing of current restrictions to the number of vaccinations undertaken with the aim being to vaccinate the most vulnerable (c13-15m) before this can occur.

Infections versus injections appears to be the main consideration for when an economic recovery can realistically begin; with April 2021 providing a considered point in time where we can expect to see restrictions gradually lifted and a movement towards sustained economic growth.

January 1st 2021 heralded a new world for the UK amidst the backdrop of a Brexit deal having been struck after almost 5 years of debate; a new relationship with the EU beckons. A resolution of Brexit uncertainty when coupled with low interest rates, low inflation and significant fiscal stimulus should ultimately support the economic recovery that is forecast.

With Brexit now firmly in the rear-view mirror and no prospect of a general election to distract us, a period of sustained political stability will bode well for UK real estate, no matter who is at the helm of the UK political agenda.

The UK property market – emerging trends to continue

Whilst uncertainty and change were anticipated at the start of 2020 for reasons unrelated to a pandemic, let us not forget that in January and even to late February/mid-March, no one was able to predict or even really consider the level of disruption that has been created by Covid-19. It is fair to suggest that no one really considered that we would all be working from home with limited social contact some 12 months later.

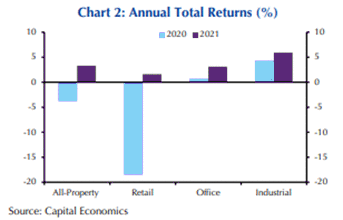

In any shock situation, whether it be caused by a pandemic or a severe recession such as 2009, there are always going to be winners and losers in the real estate markets. It comes as no surprise to see the extent of the disparity for total annual returns across the various sectors with retail experiencing the biggest negative impact:

Whilst the chart above forecasts positive returns across all sectors this year, we anticipate that a weaker real economy will induce lower rental growth in 2021, although some sectors will dramatically outperform with Industrial and Logistics continuing to buck the trend. Those that had a difficult 2020 will continue with that experience in to 2021, having to weather the ongoing challenges.

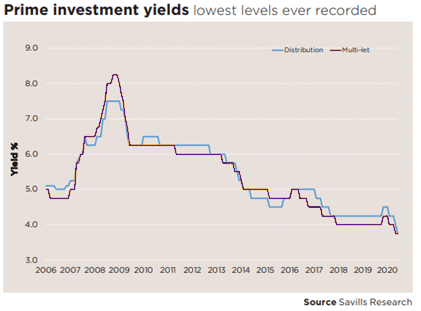

We have experienced first-hand that assets with ‘bond like’ income characteristics remain in high demand and at the very top of the list for investors allocating to real estate. Those income characteristics when applied to sectors that are benefiting from the structural changes in occupier and consumer behaviour (industrial and residential), will prove to be resilient through 2021 and beyond.

Industrial and logistics

In May last year, we wrote a paper titled ‘Rise of The Sheds’ which focused on the increasingly important role of industrial and logistics when considering the evolving nature of the UK supply chain. A shift from Covid-disrupted global and European” just-in-time” methods to UK onshoring was the likely outcome over the medium term.

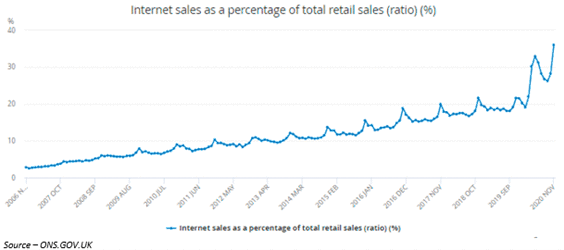

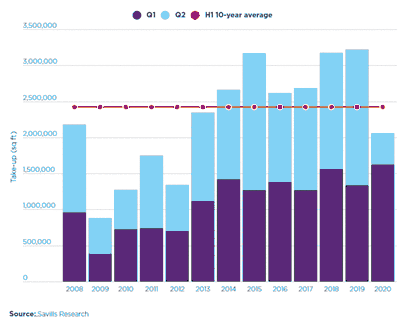

Since that article was written, the pandemic has demonstrated the fundamental role that the sector undertakes to keep food and our growing appetite for online purchases moving in line with consumer demand. This year is likely to bring continued focus on establishing more resilient supply chains, increasing stock reserves and diversifying suppliers to prevent future disruptions. The logistics sector has never been such a vital part of our day-to-day lives.

This restructuring will require additional warehousing space in the UK. If you consider the added demand pressure that will come from online retailers who are moving to increase or preserve market share, we have strong prospects for rental growth. Research by Forrester predicts that online retail sales will reach £128.29 billion by 2024, equating to 28.3% of all retail sales. For every additional €1 billion of online retail sales, it is estimated that an additional circa 775,000 sq ft of warehouse space is required. Forrester’s forecast therefore suggests that by 2024, an additional 42.45 million sq ft of warehouse space will be required to service the online retail sector alone.

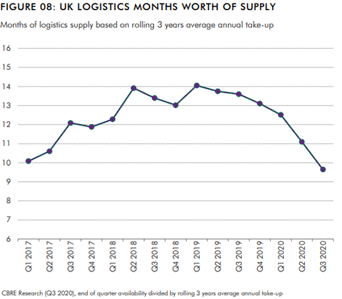

Add this consideration to an increased weight of investor demand and a lack of supply, then clearly, we have a perfect storm. Looking forward into 2021, we consider that rental growth will continue, and yields will stay lower for longer against a backdrop of sustained tenant demand for limited supply and investors demanding good quality long term income. Location and income profile therefore remain key.

Adding to the positivity in this sector, multi-let industrial continues to perform well against a backdrop of limited vacancy that is driving rental growth. Investor appetite for this sector remains strong as does the weight of capital and sentiment surrounding the market. Whilst this makes the sourcing of suitable assets challenging, opportunities exist that will perform well when adopting a robust business plan and an accretive approach to capital expenditure.

The fundamentals of a multi-tenant estate remain attractive, providing scope to create value through active asset management that approaches repositioning, regears and renewals as keenly as open market lettings to prove and enhance rental tone. The rewards of a hands-on approach to asset management for this asset class, providing a diversified and resilient income stream that has stood up against the Covid-test amidst limited tenant default, has always been its most appealing characteristic.

Retail

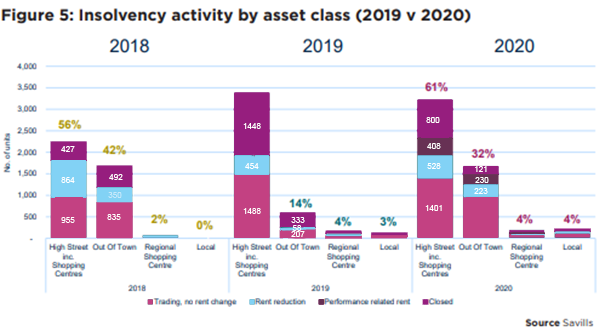

Perseverance remains the order of the day for retailers and landlords for 2021. The most recent round of lockdown restrictions will not make Q1 much easier with tenant failures on the menu amidst a backdrop of lower than anticipated rent collection figures.

We anticipate that across the retail subsectors, retail warehousing is best placed to weather the storm on the basis it still ticks a box for convenience and provides a suitable ‘click and collect’ option as retailers attempt to re-work their strategy to meet evolving customer demands. It has, perhaps unfairly been tarnished by the generalist sentiment towards the sector. Let us not forget that some goods (the bulky ones) that we want quickly, are more accessible by car from an out-of-town retail location and the process remains convenient.

As stated in the opening commentary of this note, Easter should be a pivotal point in time this year, which should translate to a more normal trading period, and possibly even a notable increase in consumer spending. This should boost rent collection and retailer performance across the sector, but we anticipate that the high street, town centre and shopping centres will continue to have a torrid time.

Re-purposing of redundant retail assets is an emerging trend. By example, our recent purchase of a vacant B&Q retail warehouse in Sheffield for Growth Fund IV will be repurposed for industrial use. Traditionally, retail warehousing was developed to a low site density to accommodate the significant parking requirement. Certain assets can now be developed more densely when positioning for industrial use.

Whilst we don’t expect this to occur in abundance (the metrics need to be right), we anticipate seeing further examples both for retail warehousing to industrial and for town centre assets to a more leisure led purpose.

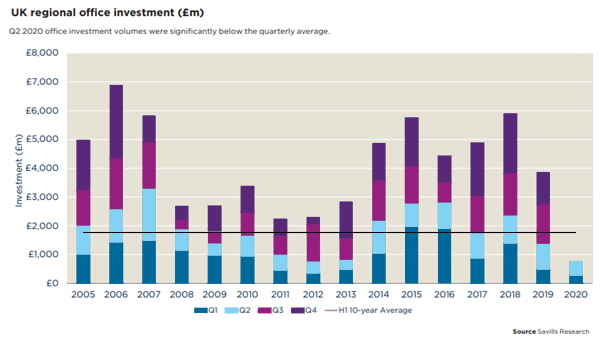

Regional offices

2020 take-up got off to a strong start, outperforming the 10-year quarterly average. However, with the UK becoming temporarily closed from March 23rd, the impact on take-up was inevitable with 2020 experiencing a 73% decrease from the 5-year average.

The emerging question that looms over this sector is whether our experience of homeworking will encourage employers and staff to pursue a more distributed pattern of work, even when the pandemic is a distant memory. A recent CBRE survey of corporate EMEA occupiers points to a substantial increase in remote working. Almost 70% of respondents suggested that they will allow employees to work flexibly in the future, which suggests that the physical office will become less important. In the noughties we went from cellular to open plan and now, the pandemic has created another seismic shift.

The UK’s crash course in Teams and Zoom has showed some businesses that they don’t need to provide workspace for all their staff and has allowed us to reimagine what work looks like and where it is located. This could lend itself to more geographic fluidity that could benefit the regional office markets.

Just like the retail sector, we consider that the office is set for a period of reinvention as we determine a new way to use it with an increasing focus on the Sustainability. Further secondary office stock will inevitably be converted to residential whilst a strong regional CBD offering, remaining the sector of choice for investors through 2021, will have to adapt to the needs of emerging trends.

Residential

Despite the impact of Covid-19, 2020 ended positively for the residential sector. Nationwide reported annual price growth of 7.3%, November transaction figures were up 13% on the same month in 2019 (HMRC) and mortgage approvals were up 58% according to the Bank of England. Sales rebounded sharply in the wake of the initial UK lockdown as the Stamp Duty Land Tax (SDLT) holiday was introduced in July 2020.

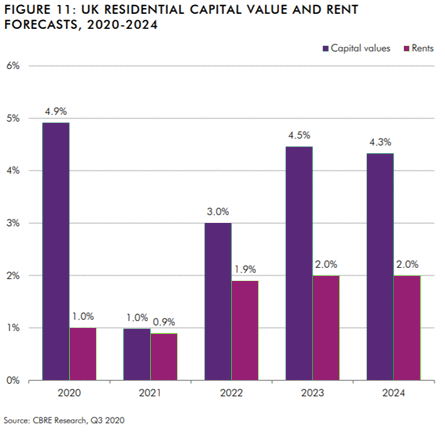

However, according to Savills, we should expect more modest price movements for 2021. The biggest influence on housing market performance will be the broader economic backdrop. Even with a rebound in 2021, weaker GDP growth and higher unemployment will cause negative impacts throughout the year. The winding down of policy support such as the Job Retention Scheme and the ending of mortgage payment holidays will put further downward pressure on the market. CBRE forecast house prices and rents to remain broadly stable in 2021, increasing by 1.0% and 0.9% respectively.

Alternatives – The care sector

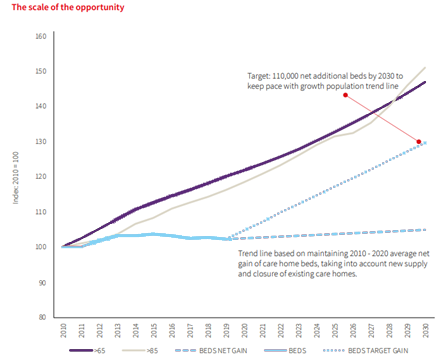

Despite being one of the largest care home markets in Europe, 78% of UK care home beds are in properties that were not originally constructed with care use in mind. With an increasing life expectancy and the rise of an ageing population, there is clear opportunity to deliver product into a market where existing stock is simply no longer compatible.

For a sector reeling from the impact of Covid-19, the pandemic has created a range of issues from a hygiene management perspective that need to be addressed. When considering that just under a third of care home beds in the UK do not have an en-suite bathroom, the ability for residents to be self-contained to avoid the spread of disease is now essential.

Over the last decade, almost 80,000 beds have been removed from the sector with the closure of 2,840 care homes. Although these have been replaced by 82,250 new beds in 1,540 care homes, the size of the sector is not increasing at the pace or scale required to match demographic changes. (JLL UK Care Homes Research 2020)

As an investment class, where the underlying fundamentals of the sector are driven by an ageing demographic and a longer life expectancy, care homes are typically regarded as defensive assets and have produced consistently high returns compared to other sectors. The MSCI index shows total returns of 8.4%, compared to 4.4% for Residential and 0.6% for All Property.

However, the lack of institutional grade investment opportunities in the sector poses one of the greatest challenges for investors. Where 78% of existing stock is facing the prospect of no longer being fit for purpose, the remainder is hotly contested with prime yields being at c 4.25% and looking stable for 2021.

Conclusion

There is a saying that when the wind of change blows, you can build a brick wall or choose to build a windmill. Whilst Covid-19 has created unexpected disruption, each sector of the real estate market will need to adapt if they are to take advantage of the change potential.

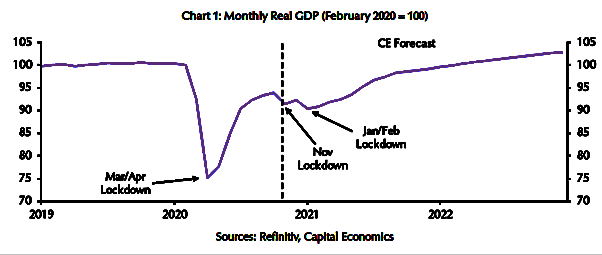

The economic outlook is far from bleak. At a macro level, Capital Economics has identified that the UK economy has developed immunity to lockdowns, as November’s second round was much less painful for the economy than the first in March/April. The forecast is much the same for the third round we are currently experiencing as we approach the Government target of April 2021 for vaccinations to be applied at the required level.

Whilst 2021 starts with unexpected restrictions, there is clear light at the end of the tunnel for what should be a very interesting and energetic second half of the year and a clear winner for the industrial logistics and care sectors, underpinning Barwood Capital’s investment strategy of pursuing value-add opportunities within the growth sectors of the UK property market.